SBI SimplySAVE Credit Card. SBI SimplySAVE Credit Card – Check Benefits, Features & Fees 2025. What are the benefits of state bank of india simply save credit card.

The SBI SimplySAVE credit card has gained a lot of traction since its introduction in 2018. The card is best suited for shoppers, especially young adults. SimplySAVE provides the user with great rewards and saves on expenses. One can gain more rewards on groceries, purchase from departmental stores, movies and dining. The joining fee is free for all eligible cardholders, but there is an annual fee of Rs.499.

State bank is generous and offers 2,000 reward points as a welcome gift. The points are convertible to gifts based on SBI offers. SBI SimplySAVE credit card helps the user save huge amounts through daily purchases and transactions. The cardholder can enjoy reward points, renewal fee waivers and another great reward from the SBI SimplySAVE card.

Benefits of SBI SimplySAVE Credit Card

- First-time cardholders get a welcome gift of 2,000 reward points if they spend Rs 2,000 in the first two months.

- For the first-time ATM withdrawal, the bank will offer Rs.100 cashback. However, the transaction should be done within 30days from the date of card issuance.

- The user will get one point for every Rs. 100 used.

- Also, the cardholder will receive 10X reward points if they spend on groceries, dining, movies, purchases from departmental stores.

- SimplySAVE credit card has great offers for individuals fueling their vehicles—the fuel surcharge waiver. The user needs to spend Rs. 500 to Rs. 3000 at the fuel station.

- Users will earn an annual fee waiver if they spend Rs.1 lakh or more.

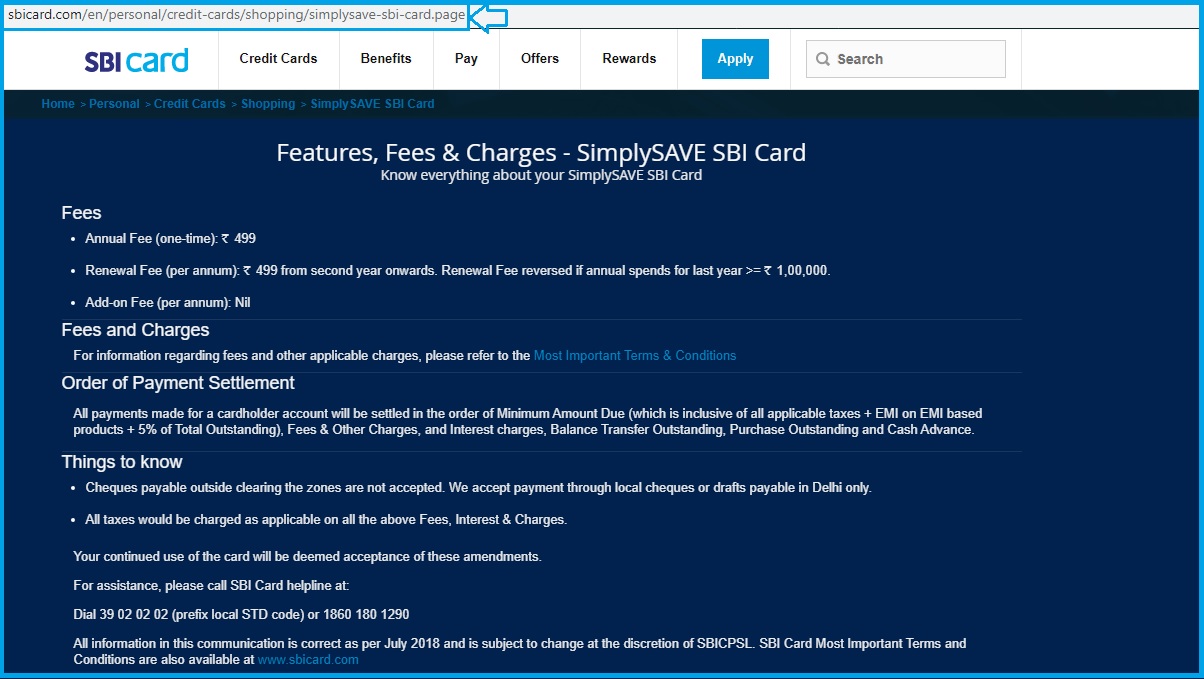

SimplySAVE Credit Card Fee and Charges Table

Eligibility Criteria

- A salaried or self-employed person can apply for an SBI SimplySAVE credit card.

- Salaried individual income should be Rs. 20,000 per month and Rs.30 000 for a self-employed individual.

For eligibility criteria check the user can follow the steps below:

- Open the SBI credit card simplifier page via the link www.sbicard.com/en/personal/credit-cards/simplyfier.page

- On the menu, select “your income and expense details.

- Enter your income and monthly expenses/expenditure and click “show my card.”

- The system will open a list of credit cards that suit your details.

- If you qualify for the SBI SimplySAVE card, you can apply by clicking the “apply now” button.

- Note the user can call the customer helpline to check eligibility criteria.

What are the SBI SimplySAVE Card Required Documents?

Ensure to provide the required details and documents while applying for a SimplySAVE card.

- Identity proof details: Aadhaar card, PAN card, passport, voter’s ID

- Address proof documents: Aadhaar card, utility bills, ration card, property registration document.

- PAN card

- Recent passport size photo.

- Applicant’s income proof: payslip, form 16.

- Bank statement.

SimplySAVE SBI Credit Card Application Process

For the online application process, the user should access the SBI credit card website page. One can also visit the bank or contact the SBI customer service desk for help.

FAQS

Can the user transfer other outstanding balances to SimplySAVE credit card?

Yes, the bank allows users to transfer outstanding balances to the SimplySAVE credit card.

Can I use a SimplySAVE credit card internationally?

Yes, the card is acceptable international, beside is Nepal and Bhutan.

SBI SimplySAVE Credit Card Apply Online

https://www.sbicard.com/en/personal/credit-cards/shopping/simplysave-sbi-card.page