Difference between SBI Elite and SBI Prime card. State Bank credit card compare. SBI Elite Credit Card & State bank Prime card Benefits & Features 2025 at sbicard.com.

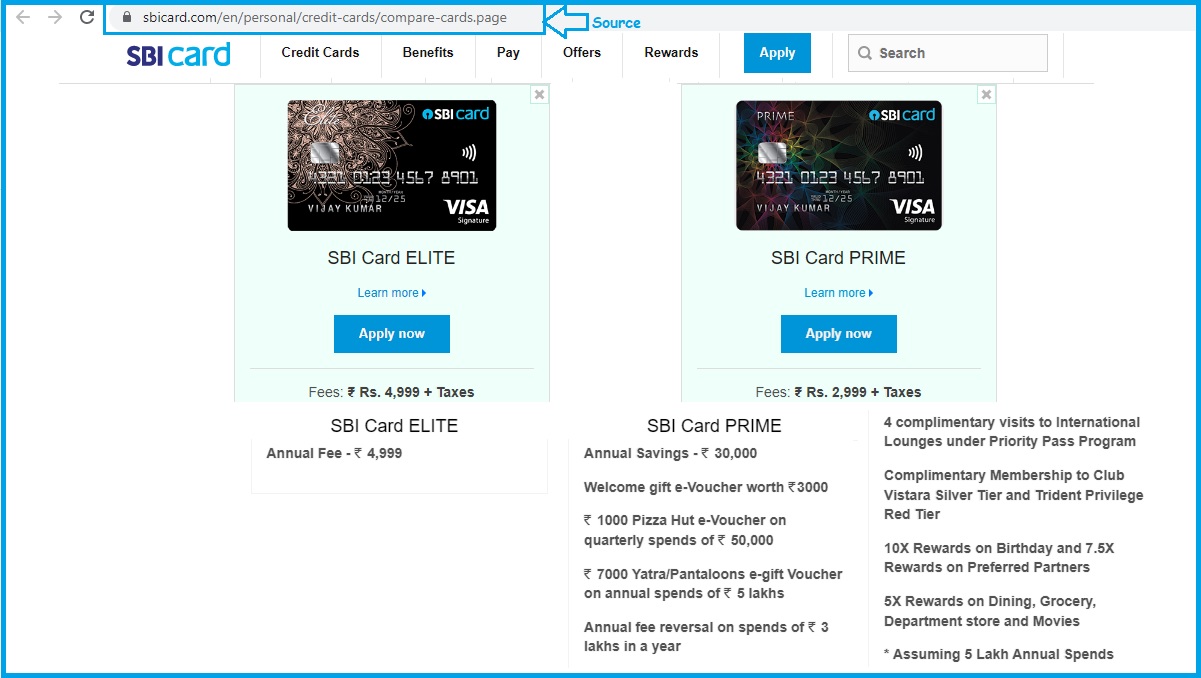

SBI Elite Card vs SBI Prime Card

All credit cards are unique and differentiated by offers, annual fee, purpose, user income and other factors. SBI bank produces credit cards to suit the customers’ needs. Some require a higher annual fee per year, while others provide better annual rewards. Credit cards allow the customer to shop and pay for purchases through credit. Each card has a set return interest rate based on the card usage. SBI bank has multiple cards to choose from and enjoy the services. To apply for any SBU credit card, the user should check eligibility criteria to ensure they meet the standards of the card.

SBI Elite credit card and SBI Prime credit card are among the best premium credit cards generated by the bank. Users can enjoy a variety of rewards based on spending. In the article, we check the comparison of the two cards.

Sbicard.com

Eligibility Criteria

The applicant must fulfill the following criteria to apply for the SBI Elite and SBI Prime credit cards.

SBI Elite credit card

- The applicant’s age should be 21 to 70 years of age.

- One should have a stable job to qualify for the Elite credit card.

- The credit score must be 750 and above.

- The applicant must be an Indian citizen.

SBI Prime credit card

- The minimum applicant age is 21, and the maximum should be 70 years.

- The applicant should have a stable income, whether in self-employment or salaried.

- The credit score should range from 750 and above.

- One must be an Indian citizen.

Comparison for SBI Elite Credit Card and SBI Prime Credit Card

SBI ELITE Credit Card

- The Bank offers an e-gift voucher of Rs. 5000 as a welcome gift from popular brands such as:

- Yatra

- Hush Puppies

- Bata

- Aditya Birla Fashion

- Shoppers stop

- Pantaloons

- Life and entertainment offer: free movie tickets for Rs. 6000 once a year.

- The applicant will enjoy a complimentary club Vistara membership.

- Trident privilege Red Tier membership for eligible applicants.

- If the user reaches the limit of Rs. 3 lakhs and Rs. 4 lakhs, they stand to earn 10,000 reward points. Also, users spending Rs. 5 lakhs and Rs. 8 lakhs will get 15,000 reward points.

- SBI Elite users will earn 5X points for groceries and dining.

- The cardholder will earn 2 points for every Rs. 100 spent.

- SBI Elite holders can enjoy 6 free lounges every year under the priority pass program. There are more than 1000 lounges available globally.

SBI Prime Credit Card

- The welcome gift e-voucher is Rs. 3000, which is less than an Elite credit card. The applicant will enjoy the offer from the following brands:

- Marks and Spencer

- Yatra

- Bata

- Hush puppies

- Pantaloons

- Shoppers stop.

- The card allows for complimentary club Vistara silver membership

- Trident privilege Red Tier membership and 1000 points during registration.

- If you spend Rs. 50000 in the quarter a year, you will get an e-voucher from Pizza Hut of Rs. 10000.

- Yatra e-voucher of Rs. 7000 after using Rs. 5 lakhs per year.

- The applicant will receive 20 points for every Rs. 100 used on standing instruction of utility bills.

- You will also get 15 points for Rs. 100 spent on Reliance smart, Reliance Trends, Reliance Fresh, Reliance footprint, BigBasket, Sahakari Bhandar stores.

- SBI Prime offers 4 complimentary visits to international airport lounges under the priority pass program. The card allows for 8 free domestic lounges with a max of two visits per quarter year.

Fee and Charges for SBI Elite and SBI Prime Credit Cards

| Fees | SBI Elite credit card | SBI Prime credit card |

| Applicants joining fee | Rs. 4,999 | Rs. 2,999 |

| Renewal fees | Rs. 4,999 | Rs. 2,999 |

| Waiving criteria | An annual renewal fee is reversed if the user spends Rs. 10 lakhs per year. | The renewal amount is waived if the user spends Rs. 3lakhs per year. |

| Foreign currency markup charges | 1.99% | 3.5% |

| Charges on ATM withdrawal | 2.5% for a minimum of Rs. 500 | 2.5 with a minimum of Rs. 500 |

| The interest-free credit | 20 to 50 days | 20 to 50 days |

| Over-limit charges | 2.5 with a min of Rs. 500 | 2.5 with a minimum of Rs. 500 |

FAQs

What are the required documents for the SBI Elite credit card and SBI prime credit card?

The eligible applicant should provide address proof documents, identity documents, residence details and colored passport photos.

For more information visit SBI card official website link https://www.sbicard.com/en/personal/credit-cards.page